LIBOR, OIS, and their derivatives

Fixed income markets

Fixed income are the biggest financial market.

Market participants have adopted the convention that a rally refers to falling interest rates, while a sell off refers to rising rates.

principal v.s. notional principal: pricipal is the real money your pay.

e.g. you pay 0 for a 100 swap

There are a lot of conventions, do not discuss them, just follow them

LIBOR

“At what rate could you borrow funds, were you to do so by asking for and then accepting interbank offers in a reasonable market size just prior to 11 am?”

FRAs (Forward Rate Agreements)

FRAs are OTC transactions.

In a FRA transaction, counterparty A agrees to pay counterparty B LIBOR settling t years from now applied to a specified notional amount (say, $100 mm). In exchange, counterparty B pays counterparty A a pre-agreed interest rate (say, 3:05%) applied to the same notional.

Because of their granular structure, they allow one to hedge the exposure or express the view on rates move on specific days.

e.g.

- an FOMC FRA is a FRA which fixes the day after a Federal Open Markets Committee meeting.

- a turn switch allows to hedge or express the view on the rate spikes idiosyncratic to the month-, quarter- or year-end.

Eurodollar futures

In many ways, Eurodollar futures are similar to FRAs, except that their terms, such as contract sizes and settlement dates are standardized.

The Merc makes daily “mark to market” adjustments to the margin account in order to reflect the changes in values of each of the individual contracts.

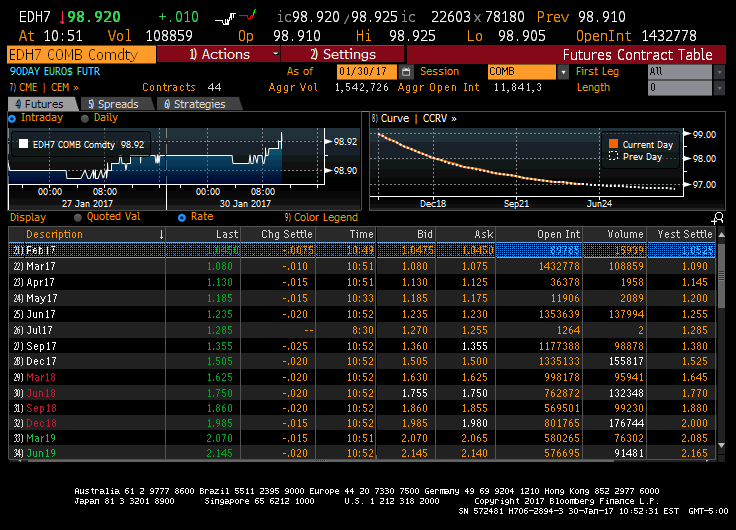

At any time, 44 Eurodollar contracts are listed on the Merc.

- ED: eurodollar

- H: March

- 7: 2017

- white, red, green name stand for different pack

Swaps

-

spot starting swap

-

forward starting swaps

OIS ( overnight indexed swap)

OIS is better than LIBOR, because it’s based on sth.

OIS is based on the overnight deposit.

LIBOR/OIS basis swaps

SOFR

SOFR is based on the volume weighted average of the Treasury repo rate, the rate on overnight loans collateralized by US Government Treasuries.

The volume is very big so it’s hard to manipulate. (~ 1 trillion)

Fed Fund futures

SOFR is based on the volume weighted average of the Treasury repo rate, the rate on overnight loans collateralized by US Government Treasuries.

Valuation of swaps

Multicurve paradigm

- Because we have a huge amount of LIBOR futures in the market

Zero Coupon Bond

Parameter

- valuation date

- Settlement date

- Maturity date

Replication of :

- Buy 1

- Sell , shares: , , so

- The value of this forward contract should be zero. After the above two steps, the cash flow is:

| Time | Cash Flow |

|---|---|

| t | 0 |

| S | -x |

| T | 1 |

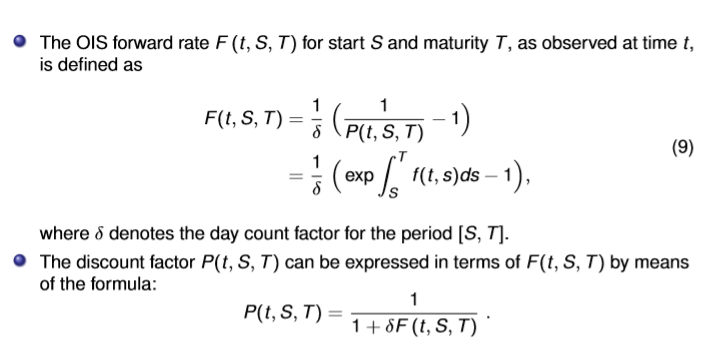

Forward Rate

The PV of a swap is the difference between the PVs of the fixed and floating legs (in this order!):

The value of swap rate is independent of the valuation date.

DVO1 = dollar value of 1.

Receive swap, long swap, means you receive fix.

You can trade swap only if you can post a margin.

the value of the swap rate is independent of the valuation date (even though the PV’s of the individual legs of the swap are clearly not).

Building the OIS / LIBOR multicurve

Only use 3 month LIBOR

Bootstrapping is useless